Powering Your Success With The All-In-One Platform For Brokers

What is Sphere’s all-in-one platform?

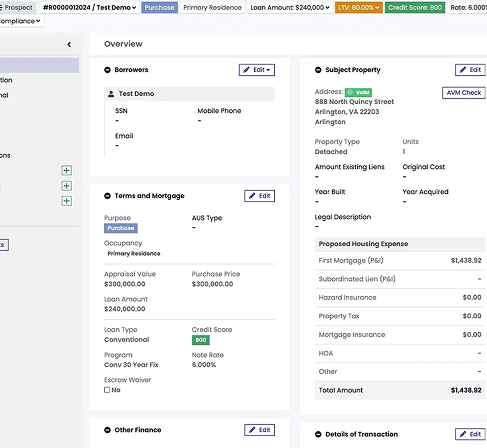

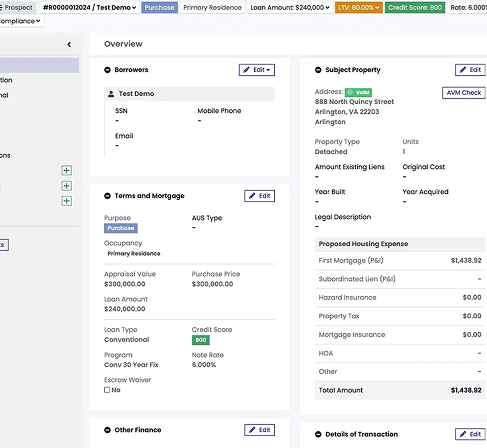

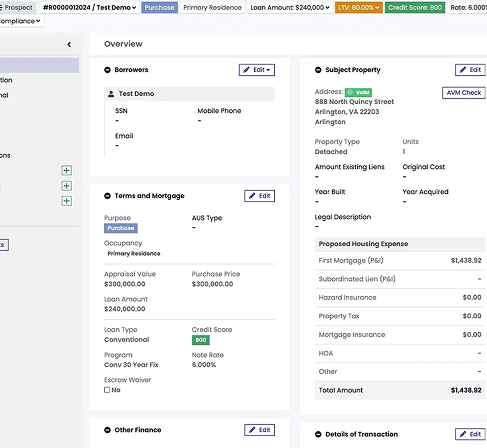

Sphere offers a comprehensive platform that integrates Loan Origination System (LOS), Point of Sale (POS), Customer Relationship Management (CRM), and Product Pricing Engine (PPE) tools. This integration streamlines the mortgage origination process, enhancing efficiency and productivity for brokers.

How does Sphere’s platform benefit mortgage brokers?

Sphere’s platform empowers mortgage brokers by providing an intuitive interface, real-time collaboration, and the flexibility to work from anywhere. It simplifies complex processes, ensuring compliance and accelerating growth in the digital lending environment.

What integrations does Sphere support?

Sphere seamlessly integrates its internal systems—LOS, CRM, POS, and PPE. Externally, it currently connects directly with lenders to achieve maximum connectivity for processing loans. Direct lender connections are designed to streamline your workflow and eliminate barriers in the lending process. Sphere also integrates with commonly used productivity platforms such SalesForce and other productivity tools.

Is there a cost to use Sphere’s platform?

Sphere is currently offering its complete platform free of charge for all mortgage brokers until February 2027. This includes full access to LOS, POS, CRM, and PPE functionalities, along with integrated features and support services. Note: Availability of free access is subject to change after February 2027.

What support and training does Sphere provide?

Sphere offers comprehensive support through a knowledgeable team dedicated to providing timely and effective assistance. Additionally, they provide guided training videos to ensure users can maximize the platform’s potential.

Can I access Sphere’s platform from any location?

Yes, Sphere’s platform is designed for flexibility, allowing brokers to work securely from any location with an internet connection.

How does Sphere ensure data security?

While specific security measures are not detailed on the website, Sphere emphasizes the importance of data security in its platform. For detailed information on data protection and security protocols, it’s recommended to contact Sphere directly or refer to their privacy policy.

What types of loans can I originate using Sphere’s platform?

Sphere’s platform supports the origination of various loan types, including conventional, FHA, VA, and USDA loans. For a comprehensive list of supported loan products, please contact Sphere directly.

Is Sphere’s Loan Origination System customizable?

Yes, Sphere’s LOS is highly customizable to meet the specific needs of different financial institutions. Lenders can configure loan application forms, workflows, and approval processes, as well as create custom reporting tools. This flexibility allows the system to be adapted to various loan types and regulatory requirements.

How do I get started with Sphere’s platform?

To begin using Sphere’s platform, you can sign up through their website. For a demonstration or more information, you can request a demo or contact their support team for assistance.

Will Sphere sell my data to third parties?

No, Sphere will never sell your data to anyone. We are committed to maintaining your trust by adhering to strict ethical standards and transparency in handling your information. Your data is yours alone, and we ensure it remains private and protected at all times.

© 2025 BrokerLOS LLC.

All rights reserved.